In this blog, we will cover and discuss getting a mortgage after bankruptcy and foreclosure. There is a mandatory waiting period after bankruptcy and foreclosure to qualify for a residential mortgage loan. Government and conventional loans have a mandatory waiting period requirement to qualify for a mortgage after bankruptcy and/or a housing event. In the following paragraphs, we will cover qualifying for mortgage after bankruptcy and foreclosure.

Can I Buy a House With a Foreclosure?

Homebuyers can buy a house after a foreclosure. However, there is a waiting period requirement after foreclosure on government and conventional loans. There are three different types of foreclosure: Foreclosure, deed in lieu of foreclosure, and short sale. The waiting period requirements depends on the type of mortgage loan program you want to apply for.

Every loan program has its own waiting period requirements. Non-QM loans does not have a waiting period requirement but requires a 30% down payment. We will be covering more about the waiting period requirements after foreclosure in later paragraphs.

FHA Loans After Bankruptcy and Foreclosure

HUD, the parent of FHA, requires a two year waiting period after Chapter 7 bankruptcy discharged date and three years from the recorded date after a foreclosure and/or deed in lieu of foreclosure to qualify for FHA loans. HUD requires a 3 year waiting period after a short sale to be eligible to qualify for FHA loans.

The date three years waiting period after a short sale starts from the date of the short sale reflected on the HUD settlement statement

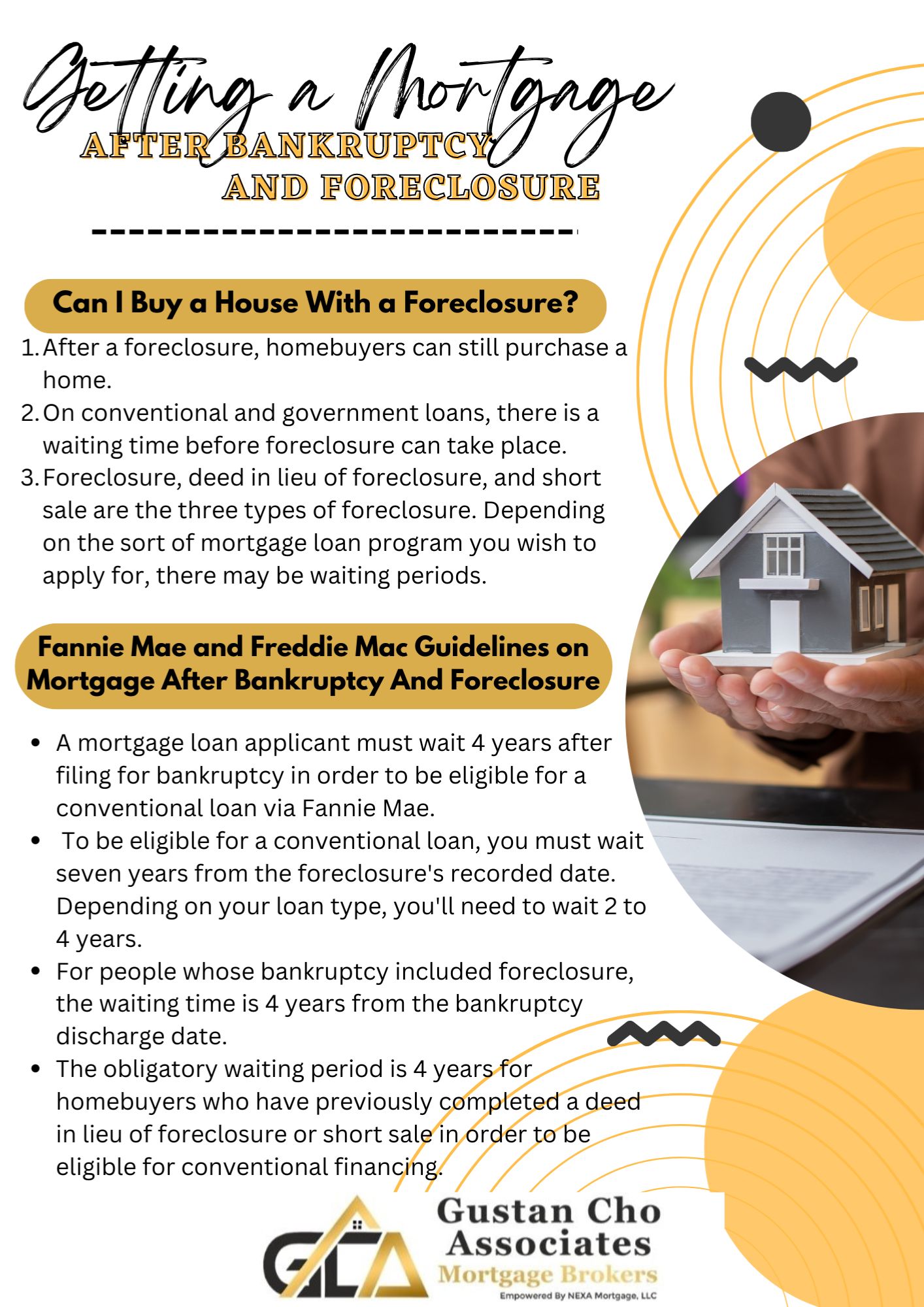

Fannie Mae and Freddie Mac Guidelines on Mortgage After Bankruptcy And Foreclosure

Fannie Mae has a mandatory waiting period of 4 years after bankruptcy for a mortgage loan applicant to qualify for a conventional loan. There is a mandatory waiting period of 7 years from the recorded date of foreclosure to qualify for a conventional loan.

For those with foreclosure as part of their bankruptcy, the waiting period is 4 years from the bankruptcy discharge date. This new rule was just implemented a few weeks ago. For those homebuyers with a prior deed in lieu of foreclosure or short sale, the mandatory waiting period is 4 years to qualify for conventional loans.

How Long Is The Waiting Period Requirement For a Mortgage After Bankruptcy and Foreclosure?

The waiting period start date is the recorded date of the deed in lieu of foreclosure or the short sale date reflected on the HUD’s settlement statement.

Removal of Bankruptcy and Foreclosure Off Credit Report Via Credit Repair

Does credit repair work? Can you get bankruptcies and foreclosures removed off credit report? Credit repair does work and I have seen some credit repair consultants that can remove not just collection accounts but the following:

- Charge offs

- Late payments

- Bankruptcies

- Foreclosures

- Deed in lieu of foreclosures

- Short sales, judgments

- Other public records off credit reports

Dangers With Removing Public Records Off Credit Reports

Nothing is wrong with getting late payments, charge offs, collections removed off the credit report. However, deletion of public records will get discovered when lenders do a national third public records search.

Do Mortgage Loan Applications Ask About Public Records?

When someone applies for a mortgage loan, they need to disclose any public records such as bankruptcy, foreclosure, tax liens, judgments even if they are no longer reported on a credit report. I have personally witnessed bankruptcies and foreclosures completely deleted from a consumer’s credit report just months after they were recorded.

Disclosing Bankruptcies, Foreclosures, Tax-Liens, and Other Public Records on Mortgage Loan Application?

When borrowers apply for a mortgage, the mortgage application will specifically ask whether mortgage applicant has filed bankruptcy and/or had a foreclosure. This questionnaire that is on page 4 of 1003, the mortgage application, needs to be answered truthfully.

Do I Need To Disclose Bankruptcy and Foreclosure Not Reporting on My Credit Report?

Mortgage Loan Applicants who have gotten bankruptcy and/or foreclosure removed from the credit report and answer they have not filed bankruptcy and/or foreclosure on the questionnaire but have, this will get discovered. All lenders will do a national third-party public records search. All public records such as bankruptcy, foreclosure, deed in lieu of foreclosure, judgments, tax liens, child support will show up. Public records will show up when lenders do a national third party public records search even though it does not report on credit reports.

Dangers Of Removing Public Records Off Consumer Credit Reports

Having bankruptcy and/or foreclosure removed from a credit report does not mean that the bankruptcy and/or foreclosure is expunged. It might be deleted off credit report but the fact still remains that consumer did file bankruptcy and/or had a foreclosure and those records are still part of public records. Mortgage Applicants do not have to worry about other derogatory items being removed from credit report such as the following:

- Collection accounts

- Charge offs, late payments

- Other derogatory items

This is because the mortgage application does not ask applicants nor does the application ask whether the applicant had any derogatory items removed.

Avoid Credit Repair During The Mortgage Process

Hiring a credit repair company and getting derogatory items deleted off credit report is totally legal. Nothing against the law in getting their bankruptcy and/or foreclosure removed off credit report due to inaccurate information but it is illegal lying about it on their mortgage application. Qualifying For Mortgage After Bankruptcy And Foreclosure are possible for all hard-working Americans.

Best Mortgage Lenders For Bad Credit

Home Buyers interested in qualifying for Mortgage After Bankruptcy And Foreclosure can contact us at Gustan Cho Associates at 1-262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans and licensed in multiple states.

We are available 7 days a week, evenings, weekends, and holidays to help. Borrowers can also email us at gcho@gustancho.com. Gustan Cho Associates can help home buyers qualifying for a mortgage after bankruptcy and foreclosure with no waiting period with our new NON-QM Loan Programs launched last year. No waiting period for qualifying for a mortgage after bankruptcy and foreclosure.